Adopting advanced technology and a big-picture approach can deliver operational and financial gains.

1. Demand forecasting is a key challenge in India’s medium and heavy commercial vehicle market, causing supply chain inefficiencies and hindering market stability. 2. Demand-supply imbalances are caused by issues such as inconsistent purchase patterns, policy changes, financing issues, and driver shortages. 3. Coping strategies include localisation, Truck as a Service (TaaS), and expanded service networks to improve supply chain resilience. |

The Indian medium and heavy commercial vehicle (M&HCV) market attracted global attention when the country’s Auto Policy of 2002 allowed for 100-percent automatic foreign direct investments. The ensuing 15 years saw the entry of numerous global players such as Navistar, Hino Motors, and MAN Motors. However, their exit was as swift as their entry, with most citing unpredictable demand and cost challenges as the primary reasons for their exit. Demand forecasting has remained the Achilles’ heel for most domestic and global players in the Indian M&HCV market. To overcome this, original equipment manufacturers (OEMs) need to adopt a multi-pronged demand management strategy.

In this article, we deconstruct the entire M&HCV supply chain in India. We describe the various levels, players, and their considerations and contestations. For that, we use data from a fleet operator’s survey, field visits, and our engagements with senior leadership of all OEMs, and verify their insights using manufacturing and distribution data. We further discuss the reasons hindering the creation of a robust demand forecasting tool/strategy. Finally, we propose strategies to narrow the gap between demand and supply for M&HCVs in India.

PARTS THAT MAKE UP THE INDIAN AUTOMOBILE INDUSTRY WHOLE

The automobile industry in India is a significant sector that involves the manufacturing, sales, and servicing of vehicles such as cars, trucks, buses, motorcycles, and scooters. Factors such as rising incomes, urbanisation, improved infrastructure, public transport development, and increased demand for personal vehicles have contributed to its growth. From 2024-25, the industry was responsible for direct employment of 4.2 million people and produced 31 million vehicles, with commercial vehicles accounting for 3.3 percent of total vehicle production in India.1,2

India is a prominent player in the global heavy vehicles segment, and features among the top five countries in the world that manufacture commercial vehicles. It ranks as the fourth-largest market for commercial vehicles globally, with domestic sales nearing one million units in FY 2023.3 Approximately 38 percent of these sales were in the medium and heavy vehicle category.4 Tata Motors Limited (TML) held a 48-percent market share in the M&HCV manufacturing space in 2023, followed by Ashok Leyland with 32 percent, and Volvo Eicher (VECV) with 17 percent.5

Along with the above OEMs, it is also important to take note of the auto components industry which generated a turnover of US$80.2 billion in FY 2024-25.6 This is a crucial part of the automobile industry and can be categorised into domestic OEMs, aftermarket sales, and exports. The supply chain for M&HCVs is complex and involves the procurement of thousands of components. Each truck consists of over 20,000 irreplaceable components, such as frame rails, cab structure, fenders, trims, and fluids. Availability and accessibility of aftermarket parts are critical within the automotive supply chain.

THE INDIAN M&HCV SUPPLY CHAIN

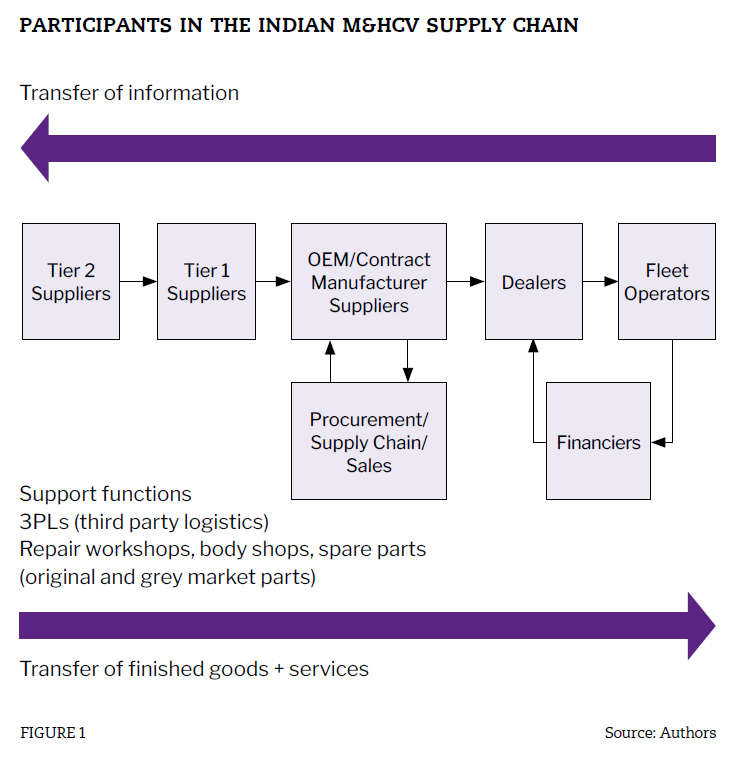

OEMs employ two approaches for component procurement: in-house manufacturing and direct procurement from vendors. The sourcing network of the truck manufacturing industry is complex, involving a multi-tiered supplier network. The procurement unit of the OEM selects reliable suppliers to ensure timely availability of high-quality components. The OEM sales teams and the financiers support dealers who sell vehicles to fleet operators and buyers. Money and information flow from downstream to upstream participants, while the product flows from upstream to downstream participants (see Figure 1).

In recent years, Indian M&HCV firms have faced challenges in truck sales, with some OEMs exiting the market while other OEMs encountered difficulties in expanding their market share. What are the reasons behind these challenges? How do the demand side challenges affect the highly complex operations of the upstream supply chain? What factors affect the matching of demand of trucks with supply from OEMs?

Over the span of six years, we interacted with more than 600 fleet operators and the prominent OEMs in India. Field visits involved the interviewing of 20 OEM suppliers to find out their challenges. In addition, systematic surveys were conducted to understand the key requirements of the fleet operators. We also engaged with senior leadership (CXOs and Presidents) at OEMs, suppliers, and dealers to understand the synergies, as well as the complex feedback loop during the sales, prototyping, and design processes.

ELEMENTS THAT MAKE UP THE FORECAST

The demand for components from OEMs relies on sales forecasts. To understand downstream demand challenges, it is important to examine upstream suppliers and the factors that impact them.

Suppliers

Suppliers produce components based on OEM orders. Each OEM may have multiple suppliers for a component and suppliers adjust their production plans based on changing demand patterns. The high variability in OEM demand poses challenges to suppliers, resulting in either excess inventory or stock-outs, both of which affect profits. Additionally, uncertain OEM demand requires suppliers to have flexible production capacity, often requiring substantial investments.

An analysis of a front axle machine manufacturing supplier’s production plan and actual dispatch reveals consistent deviations. For example, in April 2016, the supplier dispatched 444 units against a planned production of 600 units, resulting in a 26-percent gap. This discrepancy between scheduled production and actual dispatch highlights excess inventory costs for suppliers and underutilisation of capacity, leading to suboptimal returns on investment.

OEMs

OEMs receive demand projections from their sales team and dealers but forecasting market demand accurately is challenging, leading to demand-supply imbalances. Factors such as uncertain replacement demand, changes in government regulations, competitor variants, festive seasons, and changes in overloading restrictions influence demand projections. Fluctuating projections lead to multiple revisions of procurement orders, impacting supplier planning and production, and increasing the risk of supply failures.

UNDERSTANDING DOWNSTREAM DEMAND

Downstream demand for the trucks produced by OEMs in the M&HCV supply chain involves dealers and service networks along with fleet operators. Dealers and service network agents generate and convert sales leads, while fleet operators and individual buyers serve as the end consumers.

Dealers

Dealers serve as customer touchpoints by selling vehicles, providing customer service, and offering aftermarket support. They provide OEMs with monthly and quarterly demand forecasts based on factors such as growth, existing orders, enquiries, and competition. However, the actual end demand may deviate from the forecast, impacting the dealer’s sales, commission, and profitability.

Market demand uncertainty poses challenges for dealers seeking to sustain profitability. Sharp fluctuations lead to inventory management problems, with high inventory costs being generated during downturns and loss of business due to inadequate order fulfilment during upswings. A study by analytics company Crisil observed that while vehicle sales contribute to 85 percent of the total revenue for a dealer, the margin for each vehicle remained between two and four percent.7 Large fluctuations were also observed in dealership sales, with average annual sales per dealership dropping to 430-480 in FY 2021 from a high of 900-950 in FY 2019.8 The rebound has been slower, with the corresponding figure in FY 2023 being 620-670, still almost 30 percent short of the peak achieved in FY 2019. These fluctuations and low margins create a negative sentiment among dealers. In light of this, they expect OEMs to support them when navigating the complex and dynamic commercial vehicle market.

Fleet owners

Fleet operators, the primary truck demand generators, consider several factors such as pricing and the total cost of ownership while deciding on purchases.9 Some owners prefer purchasing truck chassis from local body shops at a lower cost and may omit OEM-fitted components.

Buying decisions are often influenced by festive occasions or large shipment orders, limiting dealers’ capacity to fulfil sudden orders. Brand loyalty also poses challenges for new entrants, as established brands offer extensive service networks, aftermarket support, and competitive advantages during low sales periods.

REASONS BEHIND DEMAND-SUPPLY IMBALANCES

In the M&HCV supply chain, the forecast for demand and market trends is sent from the fleet operator to the component supplier. However, forecasting M&HCV demand is a complex and uncertain process mainly due to a variety of economic, policy and operational factors as explained below.

1. Absence of scrappage policy

The lack of a scrappage policy for old vehicles makes it difficult to estimate the replacement demand accurately. An analysis of the life cycle profitability of a 32-tonne truck revealed that the optimum divestiture time is six years. However, fleet operators use trucks for varying durations, distorting the real demand pattern. The introduction of the Vehicle Scrappage Policy for heavy commercial vehicles, effective from April 1, 2022,10 is expected to make demand forecasts more accurate.

2. Challenges due to chassis-only truck purchases

Fleet operators tend to buy only the truck chassis and install certain components later, creating uncertainty in component demand. This leads to overstocking and higher inventory costs.

3. Inconsistent purchase patterns

Fleet operators have varying purchasing patterns, ranging from acquiring trucks consistently throughout the year, to making purchases on specific occasions, to doing so upon receiving large shipping orders. This inconsistency complicates demand estimation.

4. Impact of government policies

Government policies also affect market demand. Regulations such as the Goods and Services Tax (GST) and axle norms negatively affect market demand for new trucks. However, government regulations may also stimulate demand. Strict compliance with overloading regulations and higher emission standards forces fleet owners to expand and modernise their fleet. For instance, the transition from Bharat Stage (BS) IV to BS VI emission norms led to an increase in competition for obtaining BS VI-compliant input components. Thus, changes in regulations can impact procurement orders and demand for components.

5. Driver shortage and retention

Driver shortage and retention issues in the transportation industry have led to delays, missed deadlines, and reduced demand for transportation activities. It has been found that a shortage of drivers led to an estimated 28 percent of the vehicles sitting idle.11

6. Preference for an expansive service network

Fleet operators generally prefer to buy trucks from companies with a broad service and dealer network, making it challenging for new entrants to estimate demand and manage their upstream supply chain.

7. Role of financing and financiers

Fleet operators often rely on financing, which new entrants may struggle to secure. To obtain financing approvals, fleet owners may overstate their intended truck purchases, leading to inflated demand signals from dealers to OEMs. However, actual purchases often fall short, distorting demand signals and making it harder to close sales. Financiers also tend to favour established players due to the perceived scrap value of vehicles.

MATCHING SUPPLY WITH DEMAND

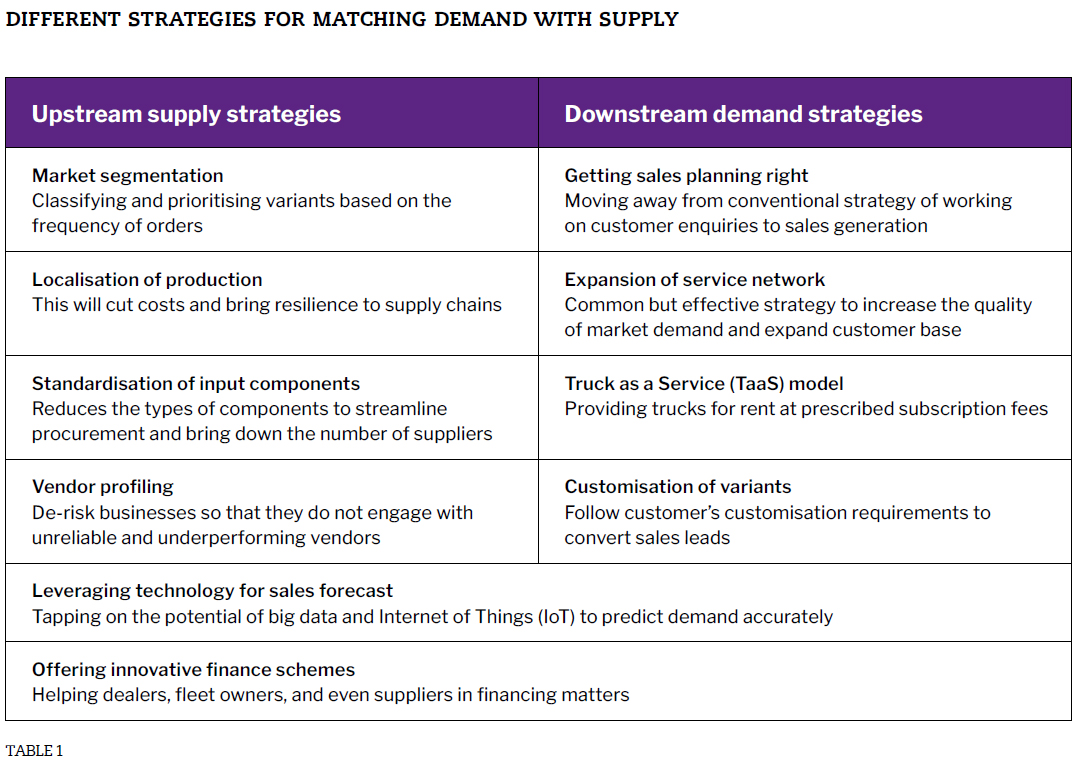

Poor demand forecasting leads to significant upstream challenges such as poor inventory management at the dealers, OEMs, and suppliers. This often causes problems such as suppliers’ lack of capacity. To address the challenge of demand-supply mismatch and its associated costs, OEMs may choose a variety of strategies (see Table 1).

Implementing innovative sales strategies

Understanding demand for different vehicle variants is crucial for efficient supply chain management. Prioritising variants with high and regular demand streamlines the flow of inputs and production planning, minimising inventory costs and stockouts. Mahindra Trucks and Bus Division categorises variants as runners, repeaters, and strangers based on market demand. Runners and repeaters are the variants that comprise the bulk of sales and reorders while strangers are the variants with low demand.

To overcome upstream supply challenges, companies employ innovative sales strategies. For instance, TML has transitioned its transaction-driven sales approach to a more customer satisfaction-oriented approach. Previously, TML’s sales relied on customer inquiries, with sales personnel incentivised based on actual sales. This resulted in limited engagement with prospective customers, hampering long-term sales generation and customer engagement. Financing offers were exclusive to converted sales, impacting forecasting and customer perception. Customers also felt disengaged from the organisation. Several “voice of customer” documents had quotes such as “…this is a large corporate which does not care about small customers like us” and “…the salesperson is good, but the experience with the finance and back-office staff is not encouraging; they do not care.”

TML implemented a new sales process that prioritised customer segmentation and satisfaction, wherein new routines were developed to segment customers according to the stages of purchase they were in from “potential customers” to “delivery completed”. This enabled it to better engage with customers on a long-term basis. Sales teams adopted a proactive approach, working as if it were their own business. As one salesperson explained, “…my job was very clear-cut and straightforward earlier on: the focus was on selling. Now, it is quite undefined, and I must work as if it is my own business. Many days, I meet customers knowing very well that they are going to buy only in the distant future.” This shift led to better quality sales leads and higher conversion rates.

Leveraging technology for better forecasts

Technology plays a crucial role in improving demand forecasts for M&HCVs, which are influenced by factors like GDP (gross domestic product) growth and regulations. Accurate forecasts are crucial to optimise operations and supplier readiness. Increasing usage of onboard IT (information technology) systems and IoT devices can help collect and analyse vast amounts of information about sales, vehicle fitness, inventory levels, and market conditions to gain meaningful insights into demand patterns and customer preferences.

IoT data, particularly on vehicle fitness, aids accurate prediction of replacement demand. Companies need to deploy appropriate technology and expertise to analyse such data effectively so that the data can reveal actionable insights. This would help them prepare production plans that reduce the need for multiple revisions. Examples include Mahindra Group’s installation of IoT devices in its trucks and tractors. The deployment of ‘Fleetman’, a cloud-enabled IoT platform by TML, and subscription-based telematics solutions by VECV, are also interesting experiments. IoT-enabled vehicles can be used for driver performance monitoring, predictive maintenance diagnostics, and real-time road congestion and weather condition updates.

However, obtaining accurate and reliable data can be challenging, especially for older trucks lacking smart sensors. Many logistics companies use third-party IoT devices to track vehicle data, making it difficult for OEMs to procure such information. These limitations can impact the quality of demand forecasts. Collaborative sharing of information and wider adoption of technology can lead to improved forecasts, reducing the need for multiple revisions and optimising operations.

Expanding service networks

A survey of fleet owners found that the availability of service support significantly influences buyer behaviour in the trucking industry. Trucks in India often break down due to poor road conditions, frequent overloading, diverse terrain and reactive maintenance practices, resulting in significant vehicle downtime. OEMs must provide robust after-sales service and expand their service network by adding more dealerships and roadside assistance points to maximise uptime. A broad service network attracts more customers and generates higher quality sales leads.

TML boasts one of India’s most extensive commercial vehicle service networks with over 1,600 workshops, 150-plus service engineers, and coverage in over 90 percent of all districts. Ashok Leyland has a mechanic club with more than 30,000 mechanics who are capable of servicing its trucks. VECV has a dealership network of over 300 dealers. New entrants like Mahindra Truck and Bus Limited offer innovative solutions to compensate for a smaller network by providing attractive after-sales service guarantees, such as mileage guarantees, 48-hour uptime warranties, and mobile service support vans. An uptime warranty is essentially a service guarantee from the OEM promising time-bound repairs in case of a breakdown or compensation for the time lost. It has emerged as a potent tool for OEMs, especially new OEMs, to instil buyer trust and confidence in the company’s service when the service network is still developing. OEMs tend to strategically locate their service stations and partner with local workshops to honour these warranties.

Enhancing supply chain resilience by increasing localisation

Bringing supply locations closer to OEM manufacturing sites reduces lead times and transportation costs, ensuring timely supply of input components and quick response to supply chain variability. The COVID-19 pandemic, geopolitical tensions, and sanctions have increased supply chain complexities. In the M&HCV industry, resilient supply chains are vital for converting leads into actual sales promptly.

For instance, Ashok Leyland has achieved an impressive 98-percent localisation rate in its supply chain management.12 Daimler India Commercial Vehicles raised its local production to 95 percent, utilising India as a transshipment hub for Europe and Brazil.13 Construction vehicles maker Sany India aims to increase its localisation level from 40 percent (as of 2024) to 75 percent by 2027-2029.14 Technology transfer, regional sourcing, and logistics localisation contribute to localisation goals. Strong partnerships with supply chain participants and supplier capacity contracts minimise procurement delays and establish resilient channels.

Truck as a Service (TaaS) model that offers flexibility to fleet owners

TaaS is a business model that enables companies to utilise and access trucks as a service, rather than owning or purchasing the trucks themselves. Essentially, it allows companies to rent or lease trucks on a temporary basis, rather than investing in them outright. TaaS providers own the trucks and offer them to clients on a pay-per-use or subscription basis. They handle maintenance and upgrades, while clients focus on utilising the trucks for their projects. By embracing TaaS, companies can reduce costs, adapt to market changes, and access cutting-edge technologies without major investments.

For example, Volvo Trucks, along with Volvo Financial Services, has introduced a truck rental scheme to attract fleet owners seeking flexibility and cost control in Brazil. The subscription-based service covers insurance, rentals, maintenance, and tax, with the added advantage of Volvo’s extensive service network. Globally, the TaaS industry is worth about US$18.4 billion, and the model is expected to grow at a CAGR (compound annual growth rate) of 25 percent between 2022 and 2031.15

Standardising input components

Standardising input components plays a vital role in streamlining the procurement process and simplifying material handling. By using standardised components with common functionalities across different vehicle variants, such as employing the same radial tyres for all models, companies can achieve greater efficiency. Standardisation reduces the need to engage multiple vendors for the same component type, improves interoperability in vehicle manufacturing, and enables the easy redirection of components for high demand variants. It reduces complexity in material handling by limiting stock keeping units (SKUs) and ensures technicians are readily available to repair vehicles, regardless of the variant. Timely repairs are facilitated by minimising differences in nuts and bolts between different variants. Standardisation helps cut component costs, service expenses, maintenance costs, and future operating costs, while incorporating the latest technology across most variants.

Developing customisation strategies that balance variety and efficiency

Different customers have different needs. Customisation refers to the ability to offer individually tailored products or services. Typically, customers have unique requirements, which then leads to the product being tailored to their specific choices. In such scenarios, there is no finished goods inventory since manufacturing occurs after getting the order. Customers benefit from unique made-to-order products that incorporate their special requirements, resulting in a better matching of supply and demand.

Market leaders in the M&HCV segment, such as TML and Ashok Leyland, offer “fully built vehicles” (FBVs) that are customised according to customers’ preferences. FBVs eliminate the need for customers to get vehicle bodies built by local shops, saving time and facilitating financing for the entire vehicle. This transition from selling just the chassis to offering road-ready vehicles helps save the time spent on getting the truck body built at local shops, which typically takes 30-60 days. Additionally, it facilitates financing for the entire vehicle which can be challenging when the body building is largely done by players in the unorganised sector.

However, customisation can affect production efficiency since the manufacturing process needs to be flexible to accommodate a large variety of customised orders, which may require different time durations. The variability in demand also poses challenges on the capacity front; when demand is low, it may be difficult to use customisation-oriented capacity for make-to-stock. Finally, it is necessary to hold a large inventory of components and raw materials: unique customer orders can draw upon unusual combinations of components, and if one of these components is not in stock, that order can be delayed. It is important to note that standardisation and customisation are not mutually exclusive. Standardisation aims to bring uniformity to processes and products, while customisation caters to specific customer needs. Therefore, a smart application of both strategies is essential for effective supply chain management.

Implementing vendor profiling

Vendor profiling is a strategic practice that involves categorising and ranking suppliers based on key criteria such as distance between suppliers and manufacturers, special manufacturing processes, and capacity. This enables buyers to identify and mitigate risks associated with unreliable vendors, while also preparing contingency plans. By ranking suppliers and assessing their past performance, firms can determine the level of supplier diversification required to minimise exposure to high-risk vendors.

Vendor rationalisation is an extension of this activity and involves categorising suppliers based on their risk of default in fulfilling orders. By reducing the number of vendors based on these risk factors, firms can streamline their supply chain, and achieve a better matching of supply and demand.

Offering financial and organisational support to supply chain participants

To ensure timely delivery of input components, firms can provide financial and organisational support to vendors facing performance issues. For vendors experiencing working capital constraints, extending loans and credit lines can help alleviate the problem and ensure on-time component supply. Similar support can be extended to dealers to keep them engaged in selling the company’s vehicles. At the sourcing end, firms can work on bringing their suppliers and the latter’s suppliers together. By fostering collaboration and knowledge sharing, valuable information about demand, process improvements, raw material sourcing, and design complexity reduction can be exchanged among partners.

This collective effort can help build an efficient supply chain, mitigating the mismatch of supply and demand, and addressing raw material sourcing issues for both the OEM and its component suppliers. Moreover, since the cost of capital for an OEM is typically lower than that of the suppliers, the OEM purchasing raw materials using its capital can help reduce procurement costs. Such a strategy not only eases the burden on suppliers but also provides a greater control of the supply chain to the OEMs.16 TML has implemented various initiatives in this regard. It has established raw material sourcing arrangements with raw material suppliers, launched driver welfare programmes like Tata Motors Samarth that aims to improve the socio-economic conditions of drivers through financial literacy and insurance support,17 and partnered with major banks to provide financing to suppliers and dealers for inventory funding. Mahindra Group has also established partnerships with several banks to meet the needs of fleet operators.

CONCLUSION

The M&HCV supply chain encounters challenges in matching demand and supply due to the volatile nature of the market. Estimating replacement demand is difficult, and factors such as an underdeveloped scrappage market, changing regulations, and limited-service networks contribute to the complexity. New entrants face additional hurdles in establishing themselves. To address these challenges, various strategies have been discussed, which include localising production to better align with market needs, conducting vendor profiling to ensure reliable supply, standardising components to improve efficiency, and leveraging technology, such as IoT, to improve demand forecasts. Additionally, innovative sales planning and expanding service networks can contribute to long-term sales growth. The emergence of the TaaS model also offers fleet operators greater flexibility. By implementing these strategies, the M&HCV industry can optimise its supply chain, and bridge the widening gap between demand and supply.

Dr Debjit Roy

is the founding co-chair of the Centre for Transportation and Logistics, and Professor of Operations Management, Operations and Decision Sciences Area at Indian Institute of Management Ahmedabad

Dr Anupam Agrawal

is Associate Professor, Department of Information and Operations Management, Mays Business School, Texas A&M University

Shubham

is Research Associate of the Centre for Transportation and Logistics at Indian Institute of Management Ahmedabad

For a list of references to this article, please click here.