The digital future of warehouses.

1. Asia’s warehousing sector faces an ageing workforce, rising labour costs, and geopolitical tensions, driving the need for resilient supply chain strategies. 2. Digital technologies like warehouse execution systems, edge computing, smart labels, and 5G connectivity enable automation, efficiency, and adaptability in logistics operations. 3. Adoption challenges such as high costs and system integration require phased implementation and government support to ensure successful transformation. |

Warehouses are critical nodes in supply chains, especially in ensuring resilience in the ever-changing macro landscape. Maintaining a robust and cost-efficient supply chain is important for companies to remain competitive, and warehousing-related expenditure usually makes up a significant portion of an item’s cost of goods sold.

Attracted by the lower labour costs payable in Asia, multinational companies have been building warehouses and supply chain nodes across the continent in recent decades, which has benefitted many Asian economies. But as several of these economies are being challenged by both an ageing population and rising wages, logistics players are facing considerable operational issues. Meanwhile, escalating geopolitical tensions in the form of tariffs have added an extra layer of unpredictability, putting additional pressure on operators to find supply chain efficiencies.

Some of these challenges can be overcome by digitalising a heretofore predominantly manual industry. This article will highlight four technologies that could address existing challenges and tackle future ones, and the strategies needed to implement potential solutions.

WAREHOUSING IN ASIA: CONFRONTING AGEING, RISING COSTS, AND TARIFFS

The e-commerce megatrend has been fuelling the growth of supply chains and logistics in Asia in recent years, resulting in warehouses such as fulfilment centres and distribution centres popping up across the region to meet the increasing demand. These warehouses have also been getting bigger to meet the burgeoning e-commerce demand.1 As square footage and business volumes surge, companies need to improve the operational efficiency of their warehouses to ensure sustainable growth in their logistics functions.2

ASEAN and much of Asia have typically been economic beneficiaries of offshoring,3 where a company moves parts of its operations, services, or production to another country, often to reduce labour costs, or access specialised talent and resources in that location. Each country can thus expand on its strengths while relying on others to fill in where they fall short. Examples of such trends can be seen clearly from Thailand developing its human capital and infrastructure to cater to automotive and high-tech manufacturing, and Vietnam capitalising on its proximity to China and its low-cost skilled labour to specialise in textiles and electronics. Singapore has also fully exploited its prime location at the tip of the Malay Peninsula, turning itself into a global supply chain hub with world-class connectivity and efficient operations.

Given the current geopolitical developments in the world, and the proposed tariffs imposed by the US, practices like onshoring and friendshoring (which refers to establishing operations in countries with similar political, economic, and cultural values) are becoming increasingly prevalent as the global economy decouples after close to half a century of globalisation.4 The global economy is threatening to split into two: the Eastern and Western Hemispheres. Significant tariffs are expected to be levied on trading partners from the “other” hemisphere. This has led to the growing popularity of the China Plus One (C+1) strategy, where companies are diversifying their manufacturing and supply chains by establishing additional manufacturing and supply chain capabilities in and out of Asia.5 Some Asian countries may even prove to be a stable location for companies seeking to counterbalance the risks from both the tariffs and C+1.6 As such, companies and logistics players will be looking to optimise their networks in countries that will be less impacted by the tariffs while ensuring a diversified supply chain.

In these countries, it is likely that warehouses may face challenges that are specific to Asia, such as an ageing workforce and rising labour costs. By 2060, Asia will account for 61 percent of the world’s population aged 65 and above, up from 56 percent in 2020.7 Given that warehousing processes such as receiving, picking, putaway, and packing across Asia are largely manual, manpower remains crucial. However, it can be challenging to attract an ageing workforce to perform these tasks. The issue is compounded by rising labour costs in Asia,8 and this will significantly impact the expenses of operating warehouses in these countries.

This situation presents an opportunity for companies and logistics players to explore the adoption of future technologies as part of their innovation planning to enhance their existing warehouses in strategic locations to meet these challenges.

TECH TO THE RESCUE

Advanced connectivity

Connectivity within the warehouse is the foundation upon which next-generation warehouse systems and automation are built. Seamless integration of data from physical assets and sensors will create a fully integrated cyber-physical environment that drives efficient warehouse operations. Such an environment also enables intelligent manufacturing and warehousing ecosystems.9

In the context of Asia’s labour-constrained and high-growth logistics sectors, advanced connectivity serves as a critical enabler for resilience and competitive adaptation, facilitating real-time analytics, remote asset control, and cross-border integration in today’s volatile trade environments.

High-throughput and low-latency networks such as private 5G and Wi-Fi 6E support real-time communication across warehouse management systems (WMS), warehouse execution systems (WES), and edge computing nodes, thereby enhancing responsiveness and operational synchronisation. WMS optimises overall warehouse operations including order processing, storage, and shipping, while WES takes into consideration dynamic real-time data such as inventory levels and product location. These systems rely on pervasive sensor networks and wireless protocols such as RFID (radio-frequency identification), Bluetooth Low Energy (BLE), and ultra-wideband (UWB) to ensure continuous data flow for inventory tracking, condition monitoring, and autonomous navigation. So far, the deployment of private 5G in logistics facilities has demonstrated marked improvements in coverage reliability, improving labour productivity by over 20 percent.10

Warehouse Execution Systems

WES function as the operational nerve centres of digitally-enabled warehouses, bridging the strategic oversight of a WMS with the real-time control capabilities of a Warehouse Control System (WCS).11,12 This enables dynamic task scheduling, resource allocation for both human pickers and automation within the warehouse, and workflow orchestration.13,14 Decision logic within the WES can be configured to prioritise orders based on business-defined criteria, allowing operations to adapt rapidly to fluctuating demand patterns.

WES facilitate real-time visibility into inventory and order statuses, as well as equipment performance, along with the ability to intervene in automated workflows to override AI (Artificial Intelligence) and manually optimise performance where needed. The adoption of WES has been associated with measurable performance gains such as reductions in order cycle time, improvements in labour productivity, and enhancements in inventory accuracy. This provides a pathway to greater agility, responsiveness, and cost efficiency for firms operating in a region with labour constraints, such as Asia.

Edge computing

Edge computing in the warehouse involves the deployment of computing resources and processing data at or near the physical location where data is generated.15 This reduces latency and enables high-speed decision-making, which is essential for automation-rich environments.16

In a warehouse crawling with automation, edge computing enhances the responsiveness of systems such as WES, Autonomous Mobile Robots (AMRs), and Automated Storage and Retrieval Systems (AS/RS). Critical decision-making tasks such as workload balancing and real-time routing can be executed locally, ensuring operational continuity during network disruptions. This also optimises bandwidth usage by filtering and aggregating data locally, transmitting only the required data to the cloud for long-term analytics and archival.

For Asia’s fast-growing and geographically dispersed logistics networks, edge computing offers a scalable solution to manage large volumes of operational data while maintaining real-time control over the distributed assets. This results in increased equipment utilisation, reduced downtime, and enhanced resilience, which are critical capabilities when ensuring operational resilience in an increasingly disruptive world.

Smart labels

Smart labels are labels with printed electronics that can capture and communicate inventory data needed in warehouse management such as location, temperature, humidity, manufacturing, and stock keeping unit (SKU) details.17 These labels can be powered by an internal printed battery, or energy harvested from radio frequency waves or light.18

Data from these labels can be fed into WMS and WES wirelessly, and then transferred using BLE, cellular networks, or Wi-Fi to enhance inventory tracking and visibility. This provides accurate real-time data on inventory levels, while any in-built sensor can monitor the environmental conditions of sensitive inventory. This helps automate many warehouse processes such as inventory tracking, checks, and environment monitoring, reducing the associated labour costs.

APPLICATION OF THESE TECHNOLOGIES IN THE WAREHOUSE

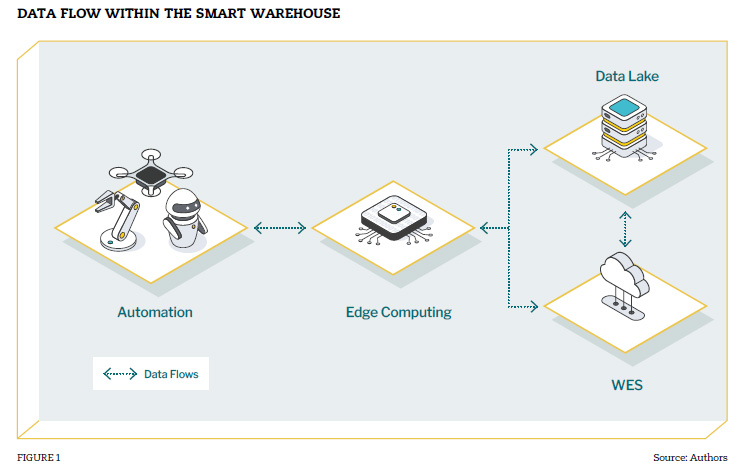

Warehouse automation delivers comprehensive operational efficiencies across key performance domains, such as throughput, space utilisation, accuracy, sustainability, and resilience. With the continued introduction of even more automation, sensors, and robotics in the warehouses, copious amounts of data are being generated, processed, and consumed at an ever-increasing rate. This is where technologies of the future can work together to enable and support the smart warehouses of the future.

Smart labels, IoT (Internet of Things) sensors, and automation team up to gather data on the warehouse’s conditions in real time. This data is fed to the WES for instant analytics and decision-making to ensure optimal performance and quick incident resolution. The ‘highway’ for data is built upon advanced connectivity, which ensures optimal uptime and sufficient bandwidth to support the transmission of these large volumes of data. Data transference is further optimised with edge computing, as simple calculations and decision-making are done locally using predetermined logic embedded into local terminals.

This allows for immediate optimisation and incident resolution for local operational decisions, while the WES performs more strategic decision-making within the warehouse (see Figure 1).

This further enhances the operational resilience of the warehouse by enabling rapid adaptation to changing conditions, underpinned by intelligent control systems and dynamic task allocation.19 Collectively, these interlinked technologies work together to enable the efficient operation of the warehouse.

CHALLENGES AND RECOMMENDATIONS FOR ADOPTION OF WAREHOUSE AUTOMATION IN ASIA’S LOGISTICS SECTOR

Warehouse automation adoption in Asia is hindered by several interrelated barriers. A principal challenge lies in the substantial upfront capital investment required for automation infrastructure, digital integration, and maintenance, which presents a significant barrier for small and medium-sized logistics operators.20 Integration complexity further complicates adoption, as legacy systems often lack compatibility with new digital platforms, leading to extended deployment timelines and heightened operational risk.21

Human factors also present obstacles: change resistance in the workforce, digital illiteracy, and organisational inertia are some common challenges faced as firms transition towards automated workflows.22 Additionally, the increased system interconnectivity raises cybersecurity risks; without robust governance, automation infrastructure becomes susceptible to cyber threats and disruptions.23 Comprehensive adoption therefore necessitates holistic strategies that address financial planning, workforce capability, system interoperability, and cybersecurity resilience.

Given these challenges in the adoption of these technologies, companies would do well to adopt proven implementation strategies in specific areas.

Firstly, these technologies can be introduced in a phased roadmap with short-, medium-, and long-term goals. In the short term, companies should try to pilot these technologies within their warehouses. This will provide the workforce with useful hands-on experience to better facilitate the integration of these technologies across the organisation. It will also reduce the initial cost of implementation, while assessment is carried out on the feasibility of these technologies and projected return of investment (ROI) rates are being calculated. Medium-term activities could involve integrating the selected technologies with existing warehouse systems, and offering value-added services to customers associated with these technologies. Finally, in the long term, companies should seek to fully integrate and realise their maximum potential while building on the learnings acquired during the earlier phases.

Secondly, in view of the potential impact of the increasingly decoupled global economy, there has been a slew of measures implemented by governments to cushion the slowdown. Companies should seek to capitalise on these measures to ease the adoption of the aforementioned technologies into their warehouses. Governments have made available special low-interest loans or preferential financing packages, grants, and subsidies for technological and infrastructural development, and lowered trade barriers such as quotas and local-content rules. Authorities have also streamlined trade procedures, lowered taxes, and provided export tax exemptions.24

CONCLUSION

In an era marked by geopolitical shifts and the opportunity to capture growth sparked by the e-commerce megatrend in Asia, logistics companies have set up more and bigger warehouses in the region to diversify their supply chain and lower costs. Due to the ageing demographics, rising labour costs, and the unknown impact of the tariffs, the current macro environment presents an opportunity for companies to revamp their existing warehouses to mitigate the impact of these factors.

Current technologies can be leveraged to help companies optimise operations, and even facilitate long-term planning. In short, digitalisation could automate and streamline what has traditionally been a manual and sometimes inefficient industry.

Toh Wei Kwan

is an operational excellence manager and principal at DNV, an energy and maritime consultancy

Lim Bing Qian

is a senior consultant specialising in logistics and transportation at a supply chain and operations practice

Dr Choo Wee Tong

is a medical doctor by training who has transitioned into entrepreneurship and education. His current work spans business leadership and teaching in the field of adult and continuing education

The authors have written this article in their personal capacity as recent graduates of Singapore Management University’s Industry Practice Master of Digital Economy

For a list of references to this article, please click here.